Let us be honest—no one likes thinking about Wills or what happens when we are gone. But if you are in a common-law relationship in Ontario, this is not something you can afford to ignore. Because here is the truth: the law does not always see your relationship the same way you do.

You might have shared a home for 10 years, raised kids together, and pooled your finances. But if you pass away without a Will? Your partner could be left out entirely — and yet, with a little planning, they do not have to be.

First, what does “common-law” even mean in Ontario?

In Ontario, you are considered to be in a common-law relationship if:

- You have lived together continuously for at least three years, or

- You have lived together in a relationship of some permanence and have a child together, by birth or adoption

However, and this is a important—Ontario’s inheritance laws do not treat common-law couples the same as married couples. And that can lead to some unexpected (and painful) consequences.

So what happens if you die without a Will?

Here is the blunt version: if you pass away without a Will, the Ontario Succession Law Reform Act kicks in.

And it does not automatically recognize your common-law partner as someone entitled to your estate. That is right. Even if you have lived together for 15 years, shared everything, raised kids—your partner might not get anything unless you named them.

Everything could end up going to your parents, siblings, or even distant relatives—while the person you built a life with is left out.

Read our blog on What Happens If You Die Without a Will in Canada?.

So what can you do to protect each other?

There is more than one way to make sure your common-law partner is looked after:

- Look into a cohabitation agreement – Sounds formal, but it can outline property rights and inheritance expectations, giving extra legal clarity

- Write a clear Will – This is your number-one move. It is the simplest, most direct way to ensure your partner is legally protected

- Consider joint ownership – Assets like your home or joint bank accounts can be set up with a right of survivorship. That means your partner gets them automatically when you are gone

- Update your beneficiaries – Life insurance, RRSPs, pensions—make sure your partner is named. These designations often override a Will.

What if you skip all this?

Well, your partner might end up in court. They could have to file a dependent’s support claim, arguing they were financially dependent on you and deserve part of your estate.

That is not just expensive—it is emotionally draining. Why put your partner through that? Especially when you can avoid it entirely by planning ahead.

Do not leave it to chance

In Ontario, the law does not fill in the gaps for common-law couples. It just does not. So if you want your partner to inherit anything—let alone be protected—you have to spell it out.

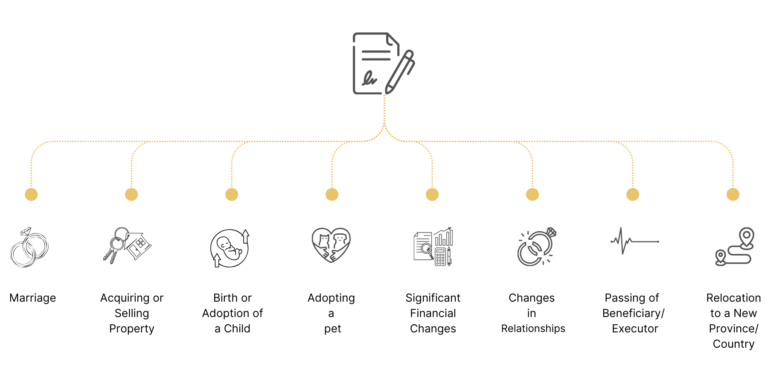

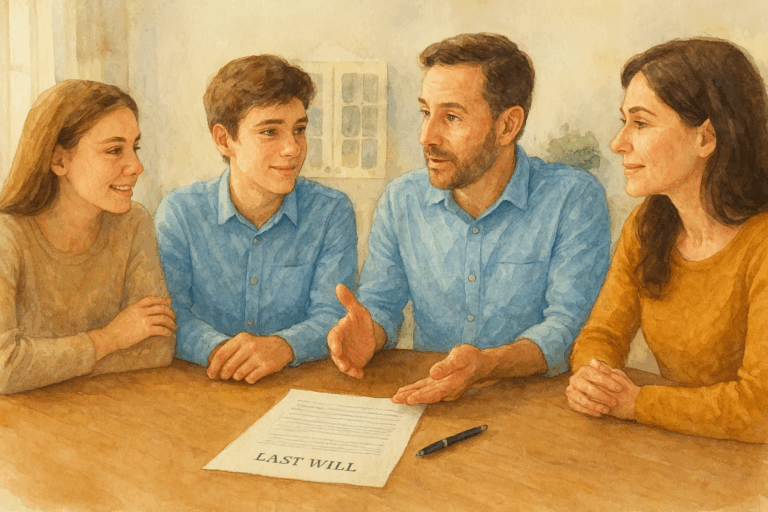

Write a Will. Keep it updated. Have those slightly awkward conversations while you still can. Because one day, those conversations might be the reason your partner has the financial stability to keep going.

And if all this feels overwhelming—there is help.

Willezy makes it simple, especially for Ontarians

At Willezy, we designed our platform with Ontario laws in mind. We walk you through the process of naming your common-law partner in your Will, setting up beneficiary designations, and explaining what each step means—clearly, without legal jargon.

You do not need to be a legal expert. You just need to care enough to take the first step.

Your life together is real. Your estate plan should reflect that.